Mighty Earth files complaint with US Securities and Exchange Commission against JBS ‘green bonds’

“Some…business leaders are saying one thing – but doing another. Simply put, they are lying, and the results will be catastrophic.” UN Secretary General, Antonio Guterres, April 4, 2022

Washington DC, January 17, 2023 — Senior executives at Mighty Earth have filed a whistleblower complaint to the US Securities and Exchange Commission (SEC), calling for a full investigation into alleged misleading and fraudulent “green bonds” issued by the Brazilian meat giant JBS.

Evidence presented to the SEC details how JBS, the world’s largest meat processor with operations in over 20 countries, issued $3.2 billion in four separate debt issuances or “green bonds” in 2021, referring to them as Sustainability-Linked Bonds (SLBs) tied to its stated goal to cut its emissions and achieve “Net Zero by 2040.”

The heart of the complaint centers on the fact that JBS based the bond offerings on its commitment to achieve net zero emissions by 2040 – but that its emissions have in fact increased in recent years and it excluded ‘Scope 3’ supply chain emissions that comprise upwards of 97% of its climate footprint. It also omitted key information from investors about the actual number of animals it slaughters each year, denying US investors vital information to make fully informed decisions about JBS’s net zero and climate-related claims as they decided whether to purchase these SLBs.

Mighty Earth’s CEO Glenn Hurowitz said:

“JBS seduced investors with sustainability pledges, but those pledges had practically zilch to do with the actual source of JBS’ supersized climate impact. Companies simply shouldn’t be able to ignore the environmental impact of 97% of their operations and then market themselves as green.”

“The fact that the meat company arguably responsible for more climate pollution and deforestation than any other in the world was able to raise $3.2 billion through green bonds is an indictment of the utter lack of safeguards in the world of ESG investing. JBS’ success in duping investors shows that SEC needs to step in right away to set clear rules about what does or doesn’t count as sustainable.”

“We need trillions of dollars in investment in decarbonization, but it shouldn’t be wasted on industrial meat companies that are driving deforestation and spewing pollution into the atmosphere.”

“The facts uncovered in today’s SEC filing should signal to investors that they can’t take company sustainability claims at face value. JBS’ materials make the company sound like Greta Thunberg even as their suppliers burned the Amazon and spewed enormous amounts of methane into the atmosphere. Before JBS makes elaborate claims like these, they need to first stop the bulldozers in their supply chain and slash their methane pollution.”

The complaint cites the official Second Party Opinion on JBS’ Sustainability-Linked Securities that concluded that the bonds “were not material to the whole corporate value chain as the KPI does not include Scope 3 emission,” which are responsible for an estimated 97% of the company’s footprint.

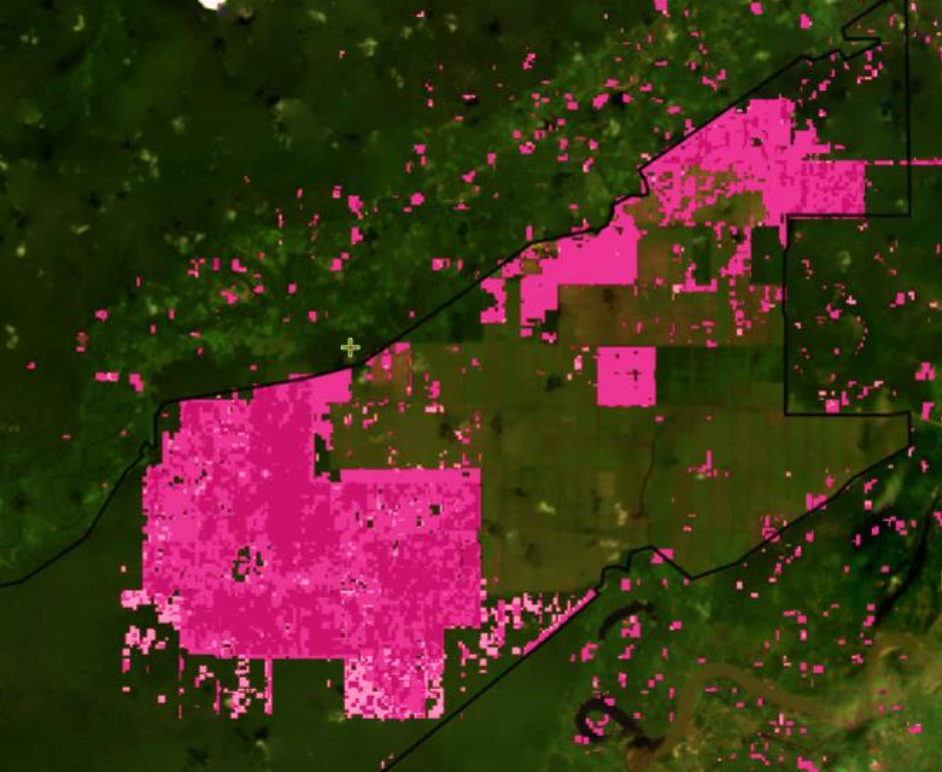

Our complaint – the first against a Sustainability-Linked Bond – highlights that since 2017 JBS has concealed the true scale of its emissions footprint, by failing to disclose the number of animals it slaughters every year, which are the primary source of its greenhouse gas (GHG) emissions. These Scope 3 emissions relate to animals in its supply chain – from deforestation, methane, and land use change to rear cattle on the thousands of farms and feedlots, which directly and indirectly produce meat for JBS in Brazil, the United States and beyond.

Despite JBS’ claims, the complaint shows that JBS is heading in the opposite direction when it comes to reaching net zero by 2040. The complaint argues that JBS omitted material information in its bond offering and investor presentations about its Scope 3 emissions. The most recent published analysis shows that instead of JBS’ emissions footprint shrinking, it is estimated to have grown by between 17% and 56% between 2016 and 2021, to 288 million metric tons CO2 equivalent in 2021, and may be as high as 541 million metric tons CO2. For context, JBS’ estimated total emissions of 288 mmt CO2 in 2021 exceed the entire emissions of Spain.

Alex Wijeratna, Senior Director at Mighty Earth, said:

“This is greenwashing so severe that we hope the SEC investigates it as securities fraud. We’re urging the SEC to conduct a full investigation into these $3.2 billion of JBS green bonds, in order to protect investors from wrongdoers who mislead, conceal, and massively under-report their climate emissions.”

Kevin Galbraith, attorney for Mighty Earth and the whistleblower, said:

“JBS’ long history of corporate misconduct – resulting in billions of dollars in fines from several governmental agencies and yet no apparent modification of its behavior – make plain that the company needs more than a slap on the wrist. These facts require an energetic investigation of the material misrepresentations that we have alleged in the whistleblower complaint. JBS’ greenwashing achieved its desired effect: the company accessed U.S. capital markets to raise billions from unsuspecting investors, including asset managers who had signed on to a pledge to avoid issuers whose conduct fuels climate change. We are confident that when the SEC’s Climate and ESG Task Force carefully examines what has happened here, it will take appropriate action to hold JBS accountable and ensure that it lives up to its environmental promises.”

Indigenous activist and filmaker, Edivan Guajajara, who supported the SEC submission, said:

“For too long big business has held all the power, deforesting at will in the Amazon to rear cattle or grow soy, on land taken from Indigenous communities. The tide is turning and we’re seeing more organizations willing to call out bad practice and pursue legal challenges. We support this, as none of us can fight this alone.”