JICA faces US Securities complaint over allegations of ‘misleading’ investors on coal

JICA faces US Securities complaint over allegations of ‘misleading’ investors on coal

Today, the Japan International Cooperation Agency (JICA) faces a first-of-a-kind complaint to the US Securities and Exchange Commission (SEC). The complainants claim that JICA stated its bond issued on US markets was coal-free, when in fact, proceeds will likely flow to coal-fired power stations in Bangladesh.

“JICA included this clause in its bond prospectus to convince investors concerned about the devastating climate impacts of coal to purchase the bond,” said Yuki Tanabe, Program Director, JACSES. “The agency can’t be allowed to get away with such flagrant greenwashing.”

Japan’s overseas development agency issued a US dollar bond in April 2021, explicitly stating in its prospectus that JICA “will not knowingly allocate any proceeds from the sale of the bonds to activities related to coal-fired power generation.” However, the complaint points to reports indicating that JICA will continue to fund coal power generation projects in Bangladesh and Indonesia, and to JICA’s own financial statements which suggest that the bonds will be used, at least in part, to fund new coal power projects.

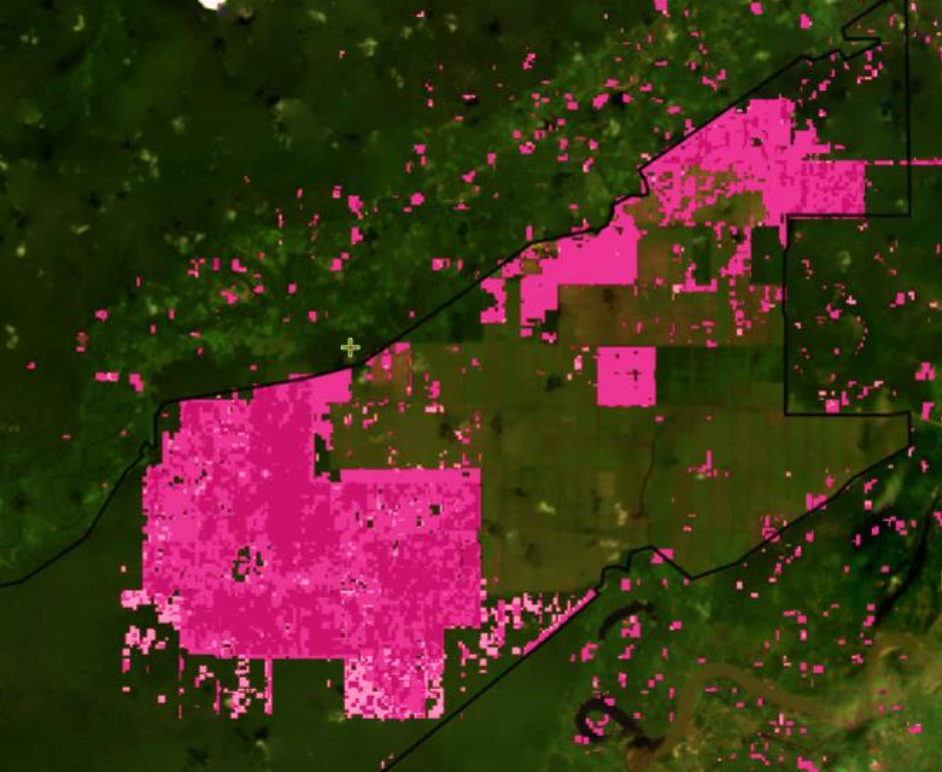

JICA is currently lending to an under construction 1,200 MW coal project in coastal Bangladesh, Matarbari, and just yesterday made an additional loan to this project.

JICA is also reportedly looking to finance a further 1,200 MW coal power project in the same region by March 2022. The Matarbari project has come under fire for faulty environmental and social assessments and inadequate compensation. Moreover, JICA has not ruled out providing finance to a 1000MW coal power station in Indramayu, Indonesia.

“We hope global bondholders take this as a warning they may still be backing new coal power if they buy JICA bonds, despite what JICA’s been telling them,” said Julien Vincent, Executive Director of environmental finance group Market Forces. “Many holders of these bonds will have their own mandates and commitments to avoid coal. If JICA continues financing coal power plants, it would not just violate the terms of this bond, but the best efforts of investors’ commitments to stay out of coal.”

Executives from five global and Japanese NGOs (Friends of the Earth Japan, Friends of the Earth US, JACSES, Market Forces, and Mighty Earth) have collaborated to bring this complaint, and are represented by US securities lawyer, Kevin Galbraith.

“As far as we’re aware, this complaint is the first time a governmental organization has been the target of a whistleblower complaint filed with the SEC, but given the SEC’s crackdown on disclosures of climate-related risk, we don’t anticipate that this will be the last,” said Mr. Galbraith. “The SEC’s September 2021 guidance indicates that truthful and complete disclosure of climate related risk is non-negotiable for companies seeking to comply with their obligations to ensure that their statements are not misleading.”

The complainants “urge the SEC to investigate these issues as soon as possible, and to impose on JICA appropriate sanctions for its material misrepresentations.”

Given the seriousness of this claim and the reports of imminent finance for Phase 2 of the Matarbari coal power project, the complainants urge “the SEC seek that JICA makes no further investments in coal pending investigation.”

At and leading up to the recent COP26 summit held in Glasgow, Japan has been the subject of global protest because it continues to fund coal power.

“Japan and its corporations will be left behind if they continue to pump money into coal power at this late date,” said Glenn Hurowitz, Chief Executive Officer for Mighty Earth. “If the only way to sell dirty coal-filled bonds is to lie to investors, it means markets have moved on from coal and Japan needs to move on, too.”

For further information please contact:

Glenn Hurowitz, Executive Director – Mighty Earth

[email protected]