Brazilian meat giant JBS’ plan to list on the New York Stock Exchange could be biggest climate risk IPO in history

Mighty Earth letter to SEC on JBS IPO Briefing for Investors Media coverage Investor opposition to IPO Supplemental submission to SEC

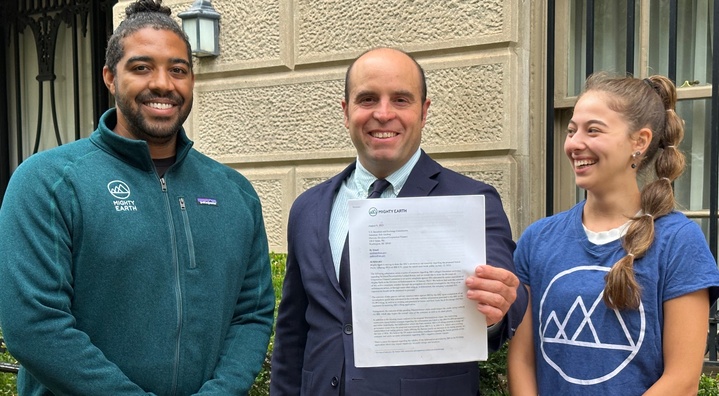

Mighty Earth lodges submission with US Securities and Exchange Commission contesting JBS plan to dual list and joins forces with civil society groups to issue warning to over 2,000 investors raising governance and climate concerns.

(Washington, DC) Mighty Earth has lodged a submission against JBS with the powerful US Securities and Exchange Commission (SEC), over the Brazilian meat giant’s plan to list on the New York Stock Exchange (NYSE) by the end of the year. The proposed restructure, ahead of the listing, could see the founding Batista family acquire up to 90% of the shareholder voting power and it could be the biggest climate risk IPO listing in history.

Mighty Earth has written to the SEC’s Division of Corporation Finance contesting the validity of the information JBS has provided in the Initial Public Offering (IPO) prospectus, which it says underestimates the company’s climate impact and misleads both the SEC and potential investors.

Mighty Earth is calling for JBS’ IPO to be scrutinized and at minimum postponed until a decision is reached by the SEC on Mighty Earth’s existing whistleblower complaint, the results of which could include a formal investigation and enforcement action. Any sanctions by the SEC could have a significant impact on the IPO process and the financial outlook of the company, leaving US investors open to risk.

The active whistleblower complaint referenced above targets JBS’ so-called “green” Sustainability-Linked Bonds (SLBs). The initial complaint was submitted by senior executives of Mighty Earth on 18 January this year and was supplemented on 11 August with additional factual developments concerning JBS’ alleged unlawful conduct.

Glenn Hurowitz, CEO of Mighty Earth said:

“This is probably the single most important IPO for the climate in history. There are profound implications for the planet if JBS, the world’s worst Amazon deforester, is given the go ahead to seek billions of dollars from Wall Street to continue tearing down rainforest, polluting on a vast scale, and driving land-grabbing.”

“Concentrating 90% of voting power in the hands of the Batista brothers, Joesley and Wesley, both acknowledged criminals, restricts the ability of outside investors to push JBS to end deforestation or deal with its outsized emissions.”

“That’s why we’re urging the SEC to fully investigate the claims made in the IPO prospectus, and to pause the IPO until the investigation into our existing whistleblower complaint is resolved.”

Background

Mighty Earth filed a whistleblower complaint to the SEC in January calling for a full investigation into alleged misleading and fraudulent “green bonds” issued by JBS. Evidence in that submission detailed how JBS issued $3.2 billion in four separate debt issuances or “green bonds” in 2021, referring to them as Sustainability-Linked Bonds (SLBs), tied to its stated goal to cut its emissions and achieve “Net Zero by 2040.” 1

The complaint centred on the fact that JBS based the bond offerings on its commitment to achieve net zero emissions by 2040 – but that its emissions have in fact increased in recent years and it excluded ‘Scope 3’ supply chain emissions that comprise upwards of 90% of its climate footprint. It also omitted key information from investors about the actual number of animals it slaughters each year, denying US investors vital information to make fully informed decisions about JBS’ net zero and climate-related claims as they decided whether to purchase these SLBs.

In 2017, members of the Batista family were involved in Brazil’s biggest high-level corruption scandal, signing a $3.16 billion plea deal. The fall-out from the scandal is estimated to have wiped 9% from the Brazilian stock exchange.

Key concerns of JBS IPO prospectus:

- Aims to restructure the business via the NYSE listing which would disadvantage its minority shareholders, giving increased shareholder voting power to the JBS founders, the Batista family, of between 85% and 90.5%.

- Offers shareholders a cash dividend payout of R$1 (Brazilian Real) per share, expected to total R$2.2 billion (US$437 million) to agree the deal.

- Includes misleading statements in the filing prospectus regarding JBS’ negative climate impacts, significantly with no mention of its methane emissions which compare to an estimated 55% of US livestock methane emissions.

- Underestimates the impact of climate change on future trading and fails to acknowledge the risks to global food production from climate change.

- Misleads by claiming to be committed to a “deforestation-free supply chain in Brazil,” when a 2022 audit revealed more than one in six cattle in Brazil – almost 94,000 – did not meet legal requirements, including links to deforestation in its supply chains.

- Plays down its role as one of the world’s worst forest destroyers, while estimates put JBS’ true deforestation footprint as high as 1.7 million hectares in its direct and indirect supply chains in Brazil.

- Shifts geographies across multiple jurisdictions by creating a new entity in the Netherlands, JBS NV, then onto the NYSE, creating risk for shareholders in exercising their rights to hold the company accountable.

Gemma Hoskins, Senior Director at Mighty Earth said:

“The IPO prospectus has serious omissions, misleading statements and frankly more greenwash, designed to present JBS as a winning proposition for the New York Stock Exchange, when nothing could be further from the truth.”

“JBS wants to list with all the benefits of a public listing while for all extents and purposes continuing to operate like a private company and avoiding US regulatory scrutiny by basing the company in the Netherlands.”

“It disadvantages other shareholders while giving unprecedented control to the Batista brothers, who have pleaded guilty to criminal acts. All this while JBS reports major losses. How can this be an appealing proposition for investors?”

Kevin Galbraith, US securities attorney for Mighty Earth, said:

“We urge the SEC’s Division of Corporation Finance not to give JBS the green light on its plans to move forward with the IPO without first considering the existing submission which is with the SEC’s Division of Enforcement. In that complaint we demonstrated how JBS accessed U.S. capital markets to raise billions from unsuspecting investors, including asset managers who had signed on to a pledge to avoid issuers whose conduct fuels climate change. We believe that evidence alongside our recent analysis of the IPO prospectus shows that JBS is once again hell bent on harming US investors and misleading markets.”