McMethane Burgers

By Sammy Herdman

McDonald’s can expand its stale menu, or innovate to become a climate leader.

The Methane in the Menu

The McDonald’s menu may be one of the most widely read objects existing today. In more than 100 countries, 70 million people ordered from the McDonald’s menu in 2024. That’s an order of magnitude more reads than any of the top ten global bestselling books of 2024 received… combined. In other words, McDonald’s menu has enormous exposure and far-reaching influence. The menu also pulls in a huge revenue – more than $25 billion in 2024.

Thanks to Big Macs and Happy Meals, the McDonald’s menu is full of items that emit high levels of methane, which is a superheater greenhouse gas, 86 times more powerful than carbon dioxide over 20 years. Methane is rapidly heating up the climate, driving the frequency and severity of heat waves, droughts, and wildfires. Fortunately, methane only lasts in the atmosphere for about 12 years, so reducing methane emissions today can slow global warming in just over a decade. That’s why more than 160 countries have signed onto the Global Methane Pledge – committing to reduce methane emissions by 30% by 2030. The greatest source of man-made methane globally is animal agriculture, primarily from cattle.

Unsurprisingly, the McDonald’s menu is dominated by beef, dairy, and other meat products. In fact, items like the Big Mac and the McRib make McDonald’s the world’s largest purchaser of beef and pork, and the second greatest purchaser of chicken, giving McDonald’s enormous influence over global meat supply chains. It’s been reported that beef generates one-third of McDonald’s overall greenhouse gas emissions. Yet, McDonald’s seems to ignore the problem of methane. In the company’s 2024 Impact Report and on its website, the impact of methane emissions from meat and dairy on the climate isn’t even mentioned.

Without menu innovations, it is all but guaranteed that as McDonald’s grows, so will its methane emissions. And McDonald’s is pursuing an aggressive growth strategy: between 2019 and 2023, McDonald’s grew 30%, and by 2027, McDonald’s plans to open 7,000 new stores. With each new store, more consumers will be ordering off of McDonald’s menus, which, as they stand, are full of high-emitting items.

McDonald’s, Some Climate Commitments and Many Challenges

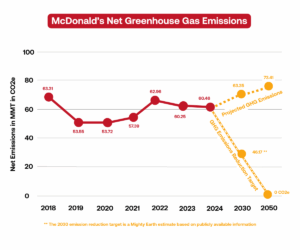

McDonald’s overall greenhouse gas emissions have been trending upwards since 2019. This trend is driven by the growth in the company’s Scope 3 emissions, which make up around 99% of McDonald’s climate footprint. Scope 3 emissions include all of McDonald’s indirect emissions, from the farms where cattle are raised, to the landfills where leftover food is thrown away. This trend undermines McDonald’s statedclimate targets.

McDonald’s has an SBTi-validated goal to reach net-zero emissions by 2050 across all of its operations (Scope 1), energy use (Scope 2), and its value chain (Scope 3). McDonald’s also has interim targets for the end of 2030. From a 2018 base year, McDonald’s committed to reduce its Scope 1 and 2 emissions by 50.4% — a goal for which the company is on track. However, if McDonald’s continues with business as usual, it will not achieve its target to reduce energy and industrial Scope 3 emissions by 50.4% and forest, land, and agriculture (FLAG) Scope 3 emissions by 16%. And ultimately, as long as McDonald’s continues to expand without addressing the methane in its menu, the company’s net-zero goal is hopeless.

The Tried and True Obvious Solution

McDonald’s can accomplish both growth and climate targets with some menu innovation. Plant-based ingredients are much more climate-friendly than meat and dairy, especially beef products. Replacing meat and dairy sales with plant-based alternatives by setting sales ratio targets for animal- and plant-based proteins could decouple McDonald’s growth from its greenhouse gas emissions.

McDonald’s competitors already sell plant-based items, and crucially, they’ve invested in marketing the plant-based options to increase sales. For example, Burger King rolled out the Impossible Whopper in 2019 and has been introducing ad campaigns to boost sales. Now in Germany, one out of every five Burger King whoppers and one in every four Long Chicken Sandwiches sold are plant-based. To build upon that success, Burger King Germany has priced plant-based versions of some products at a lower price than animal-based versions. Meanwhile, McDonald’s piloted a McPlant burger in 2019 in several US cities, butdiscontinued it without even attempting a nationwide rollout. Considering Burger King’s success with plant-based menu items, it is surprising that McDonald’s hasn’t followed suit, especially considering the many other advantages it would provide.

Plant-Based Positives

Introducing and promoting plant-based menu items would have many benefits beyond bringing McDonald’s closer to its climate targets. And on the flip side, not transitioning to plant-based menu items creates risk for the company. In its annual report, McDonald’s recognizes the risk that climate change and climate-related regulations pose to the company. In particular, climate change could impact McDonald’s infrastructure, supply chains, and consumer markets, all potentially harming profits. Without innovation, McDonald’s menu will continue to drive high levels of methane emissions, thus hastening the negative impacts of climate change.

Transitioning to plant-based items would also help McDonald’s achieve and maintain its commitments to eliminate deforestation in its supply chain. Notably, deforestation in the Amazon and other nearby biomes is driven by demand for soy, a main component of chicken feed. In order to meet its deforestation commitment, McDonald’s has long been a strong supporter of the Amazon Soy Moratorium (ASM). It is important that McDonald’s continue to be a leader by strongly and publicly reaffirming its support of ASM, but also, McDonald’s could reduce its reliance on soy altogether by selling more plant-based foods.

McDonald’s recognizes that there is risk implicit in their reliance on meat products. The McDonald’s annual report acknowledges that meat and chicken are commodities subject to increased price volatility, with the ability to harm profits. Additionally, in a lawsuit filed against the four largest beef packers in the US, McDonald’s stated that price-fixing schemes driving up the price of beef are easy to organize in a highly concentrated market – this makes the US beef industry a risky supplier for McDonald’s.

McDonald’s recognizes that there is risk implicit in their reliance on meat products. The McDonald’s annual report acknowledges that meat and chicken are commodities subject to increased price volatility, with the ability to harm profits. Additionally, in a lawsuit filed against the four largest beef packers in the US, McDonald’s stated that price-fixing schemes driving up the price of beef are easy to organize in a highly concentrated market – this makes the US beef industry a risky supplier for McDonald’s.

Finally, introducing more plant-based alternatives to the McDonald’s menu will increase the company’s consumer base. Heart disease is the leading cause of death globally and saturated fats found in meat products contribute to cardiovascular diseases. However, plant-based alternatives are lower in saturated fats and higher in dietary fiber, making them a ‘heart-healthy’ option for millions of consumers with cardiovascular diseases. Beyond health-conscious consumers, McDonald’s can draw in plant-based consumers.

The Next Move for McDonald’s

By establishing third-party verified climate targets and measuring its greenhouse gas emissions annually, McDonald’s is set up to become a true climate leader in its industry. However, there is still work to be done. Considering that McDonald’s is such a large purchaser of beef and dairy, it is essential that they calculate and publish their annual methane emissions. McDonald’s must commit to reducing their methane emissions by 30% by 2030 – in line with the Global Methane Pledge. And finally, McDonald’s can achieve methane and other greenhouse gas emission reductions by introducing more plant-based items on their menu, globally, and promoting those plant-based products. And in doing so, the McDonald’s menu would become an agent of climate protection.