CEO Note: Trump’s SEC has given JBS the green light to list on the NYSE

By Glenn Hurowitz, Founder & CEO

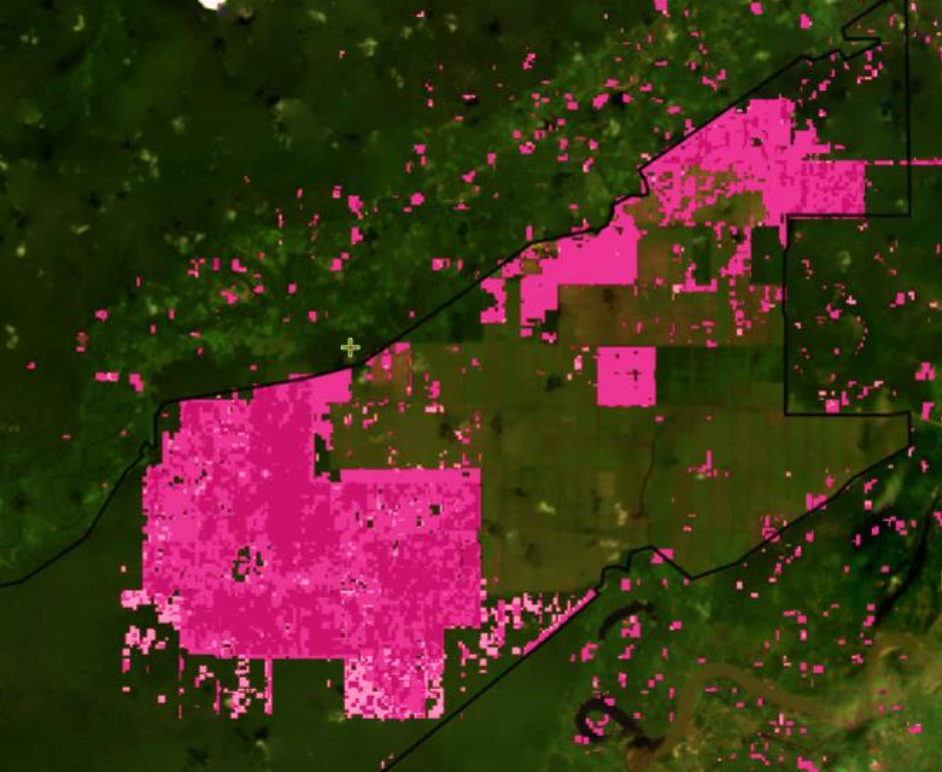

President Trump’s Securities and Exchange Commission (SEC) approved the listing on the New York Stock Exchange for JBS, the world’s largest meat company. This listing will provide JBS access to US capital markets, potentially allowing it to bring its deforestation and climate pollution (already estimated to be at the level of the whole country of Spain’s) to a new scale.

The approval came days after it was revealed that JBS subsidiary Pilgrim’s Pride made the biggest single donation to Trump’s inaugural committee of $5 million. During Trump’s first term, the SEC and Department of Justice fined JBS and its parent company over $280 million for participation in a massive bribery scheme connected to their acquisition of Pilgrim’s Pride, among other violations. Since agreeing to the SEC and Department of Justice’s findings of corruption in 2020, JBS has continued to issue misleading information to investors about its risks and has even sought to evade the fines it was ordered to pay. Given the company’s long rap sheet of illegal and corrupt conduct, it’s hard to see how the SEC could have confidence that JBS won’t deceive US investors. JBS has issued misleading climate data to investors and consumers, prompting New York State Attorney General Letitia James to sue it. McDonald’s recently sued JBS for price-fixing. And cattle ranchers have objected to their treatment by JBS and are worse off by the Trump administration’s action.

Mighty Earth’s groundbreaking investigation of JBS greenwashing helped delay the IPO.

The approval of JBS’s IPO shows this is no longer the independent SEC that has upheld honest practices on American markets for nearly a century. SEC’s decision-making around this should be subject to investigation given JBS’s recent donation to Trump’s Inaugural Committee. The listing now heads to the New York Stock Exchange, which we hope isn’t as easy to corrupt, and upholds its standards by keeping a company known for corruption and dishonesty out of the market.

Mighty Earth and allies’ work has delayed the approval of this listing for nearly two years, significantly disrupting JBS’ plans and forcing changes in JBS’s disclosures. Based on our meetings, I don’t believe this IPO would have happened but for the change in administration.

We hope our work with allies has helped create pressure on the company to address their climate and governance issues. We’re going to keep working through private sector pressure and governments to change the company and the meat industry as a whole to end deforestation, reduce their climate pollution, and drive a shift to more sustainable protein.

—

© 2025. The text of this article is openly licensed under Creative Commons (CC BY-ND 4.0); you are free to copy and redistribute or republish the article in its entirety with attribution and credit.