Mighty Earth publishes SEC whistleblower submissions against JBS

By Jordan McDonald, Senior Associate, Mighty Earth

For the first time, Mighty Earth has published a cache of its groundbreaking Whistleblower complaints to the US Securities and Exchange Commission (SEC) against $3.2bn of JBS’ fraudulent Net Zero-related ‘Sustainability-Linked bonds’.

Our set of challenges against Brazilian beef giant JBS, initiated in January 2023, have drawn global attention to JBS’ non-existent Net Zero by 2040 plans.

Our legal submissions are especially relevant as the SEC assesses whether to green light JBS’ controversial plan to list on the New York Stock Exchange (NYSE) – a deal we have described as “the biggest climate risk IPO in history.”

Through our initial Whistleblower complaint, we alerted the SEC to how JBS – the world’s largest meat company, with climate emissions greater than Spain – misled investors with its unvalidated net zero plans and highlighted that they did not cover its ‘Scope 3’ supply chain emissions. According to JBS’ own admission, its Scope 3 emissions account for 97% of its total climate footprint.

The New York Attorney General Letitia James seemingly agrees with our analysis to the SEC and recently sued JBS in the New York Supreme Court for making misleading, deceptive and fraudulent Net Zero by 2040 statements in relation to its beef sales.

Timeline: Calling out JBS’ false Net Zero claims

Timeline for JBS Blog-3Timelines resources are linked below

Since our initial Whistleblower complaint to the SEC, we have submitted three supplemental filings to the SEC on August 11 and November 6 in 2023 and on March 27 this year.

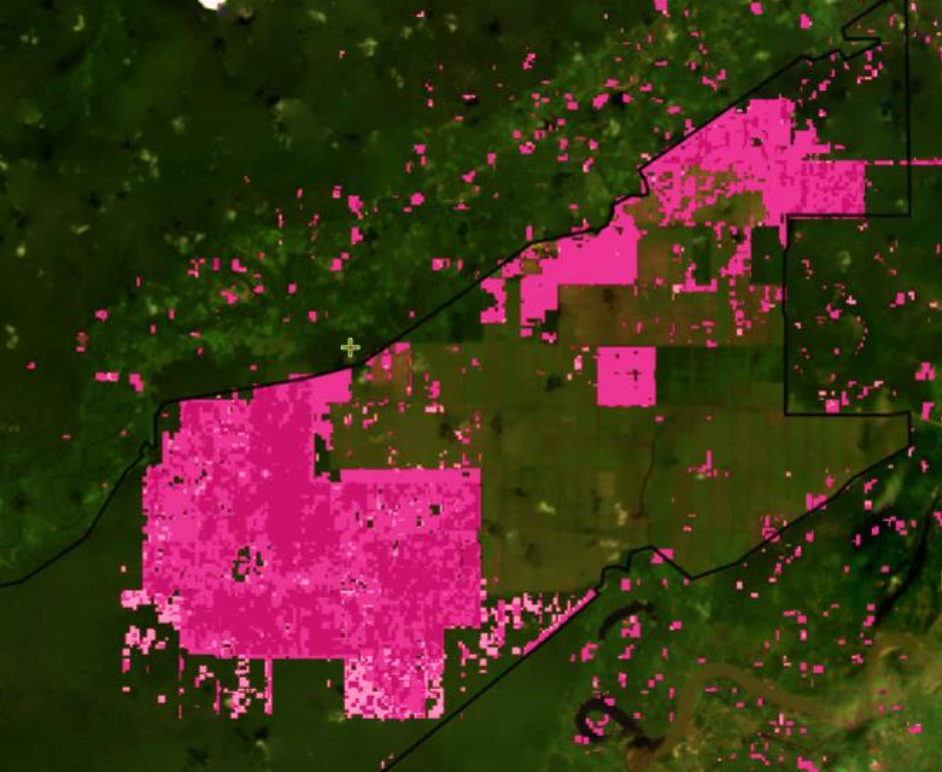

These submissions reinforce our initial complaint, revealing a body of evidence that cast doubt on the validity of JBS’ Net Zero by 2040 commitments. Coupled with JBS’ continued involvement in widespread deforestation in Brazil, links to human rights abuses and widespread corruption, these revelations underscore the urgency for the SEC to take decisive action to investigate JBS’ alleged fraudulent climate claims.

Instead of addressing its outsized climate emissions and stamping out deforestation in its beef and soy supply chains, JBS appears more focused on expanding its global meat empire. The company plans to list on the New York Stock Exchange (NYSE) to access billions in capital to fuel its global growth and expansion, and recently celebrated plans to operate the largest beef plant in Latin America, capable of slaughtering up to 4,400 cows a day.

We are calling on the SEC to investigate JBS’ $3.2 bn in misleading “Sustainability-Linked bonds” and to halt its NYSE listing until our Whistleblower complaint is resolved and all other allegations against JBS have been fully assessed.

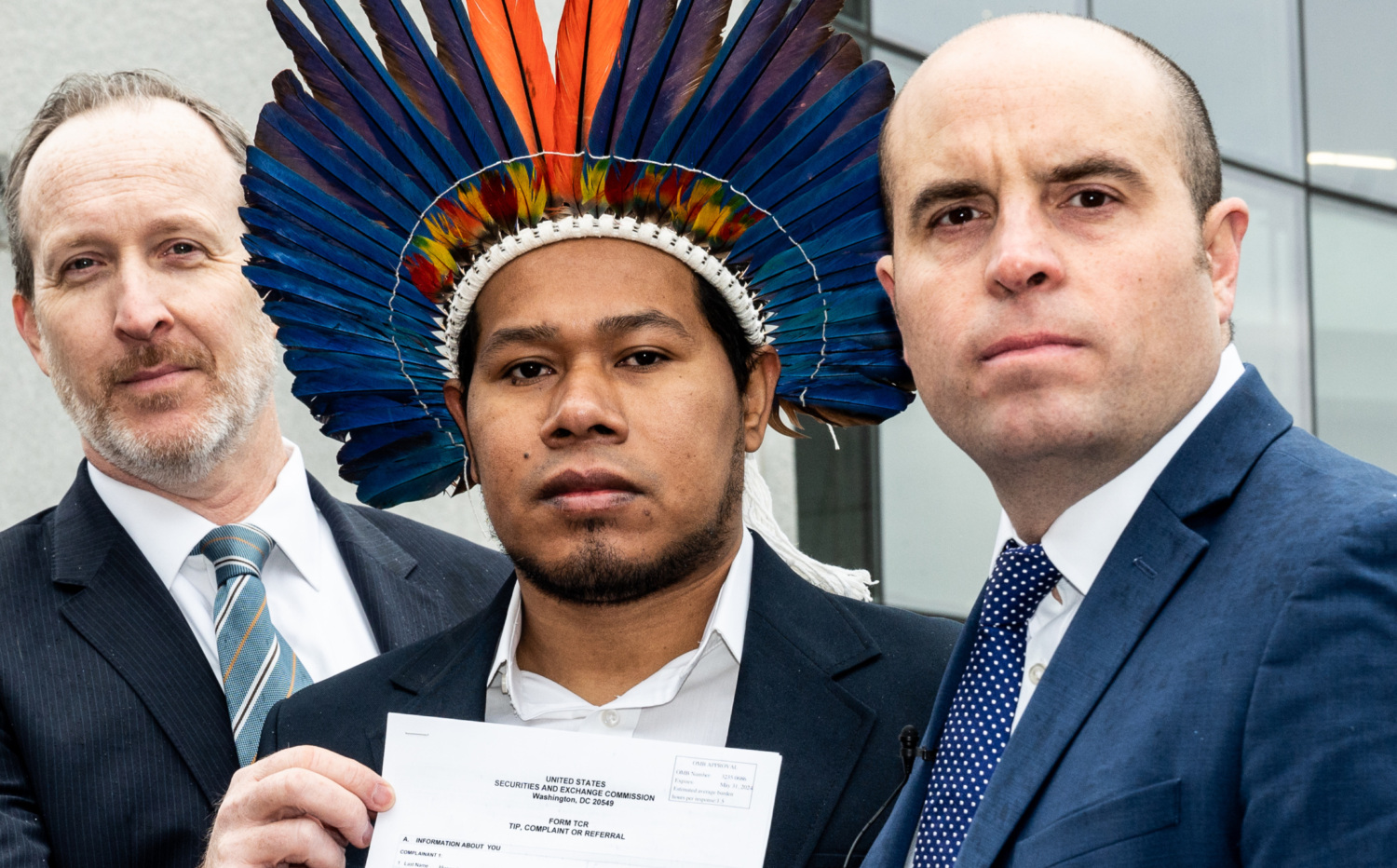

Kevin Galbraith (Attorney for Mighty Earth), Edivan Guajajara (Indigenous activist & filmmaker) and Glenn Hurowitz (CEO of Mighty Earth) handing in Mighty Earth’s Whistleblower complaint to the SEC on January 17, 2023.

Kevin Galbraith (Attorney for Mighty Earth), Edivan Guajajara (Indigenous activist & filmmaker) and Glenn Hurowitz (CEO of Mighty Earth) handing in Mighty Earth’s Whistleblower complaint to the SEC on January 17, 2023.